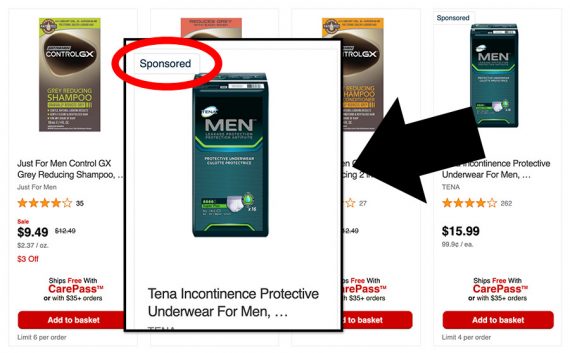

Numerous large retailers now sell ads on their own ecommerce sites. The ads use first-party transactional data to target consumers with products on the retailer’s site or the advertiser’s.

Amazon was among the first to popularize the idea of a retail ad network, but in 2022 many enterprise retailers sell ads, including Walmart, Target, Home Depot, Kroger, CVS, Walgreens, and Wayfair.

CVS is one of several enterprise retailers that now allows on-site advertising. The ads link to products on CVS’s site and, also, on the advertiser’s.

Bain & Company, the investment firm, estimated that retail ad networks would drive $25 billion in revenue by 2023. Thus the practice is growing, and it could impact ecommerce in multiple ways.

Marketplaces

Without any help from retail ad networks, marketplaces are already a key channel for retail and B2B sales.

All of the retailers mentioned above had marketplace services before retail ad networks. But the networks could produce a virtuous cycle. Marketplaces generate more traffic for retailers. More traffic leads to more revenue from ads, encouraging retailers to expand and grow marketplaces.

Retail ad networks might also drive the creation of new marketplaces. For example, groups of small and midsized retailers could collaborate to form marketplaces, which could become retail ad platforms. Large consumer packaged brands might start their own marketplaces, and B2B marketplaces could emerge, too. In each case, advertising sales would likely follow.

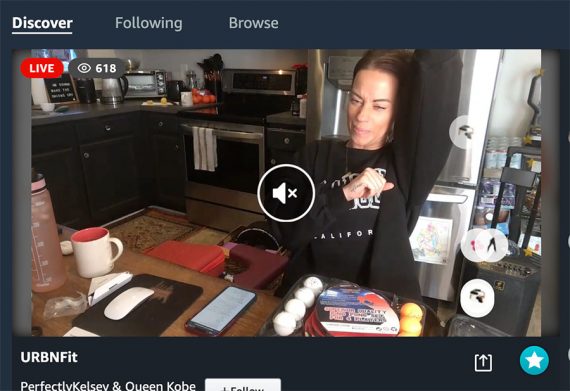

Commerce Video

Retailers are using video and live-streams to sell products. That trend could be mutually beneficial with retail ad networks. Traffic and time-on-site drive ad revenue. Live-streams and videos boost traffic. More traffic drives more ad revenue, and so on.

Don’t be surprised if the videos and live-streams themselves contain or become ads. The same advertisers that buy pre-roll promotions on YouTube could be interested in live-stream investments on Amazon, Walmart, and the like.

Amazon has dozens of live-streams promoting products.

DTC Growth

Many direct-to-consumer brands have flourished thanks to audience targeting on Facebook and other social platforms. But in the face of new privacy practices, targeting shoppers using third-party data has become less effective.

Retail ad networks, however, rely on first-party data. In some cases, retailers have long transaction histories from customers. Just think about how many times a customer might have ordered from Amazon, Walmart, or CVS. In other cases, the data could come from loyalty programs that capture in-store purchase history.

First-party data allows for precise targeting and personalization without many of the privacy concerns associated with cross-site tracking.

DTC brands that have experienced rising customer acquisition costs on Facebook could benefit from retail ad networks.

New Competitors

One can only imagine that someone in Meta’s army of engineers is looking at retail ad networks for opportunities.

Those networks are presently limited to enterprise retailers. But Meta, Google, and others could bring retail ads to small and mid-sized merchants. Meta and Google could transform their existing ad platforms into a SaaS solution that just about any retailer could employ.

In fact, retail media could be another example of how Meta could dominate commerce. Meta (Facebook) could easily create an ecommerce ecosystem that included a retail ad network powered by first-party transactional and behavioral data.

Meta is not the only company well-positioned to bring retail ad networks to the merchant masses. Google, Shopify, BigCommerce, Mailchimp, and several others have the opportunity to expand into retail ads, bringing more competition.

Ad Diversification

Such retail networks could lead to ad diversification in at least two ways.

First, brands could diversify advertising channels. Many DTC and even consumer-packaged-goods brands rely on Facebook, Google, and Pinterest to drive sales.

Those same brands could add retailers to the lists of ad platforms they use.

The second form of diversification is the types of ads. Most ads on retail networks are product-specific, but the same first-party data that identifies a probable buyer of a product might also target someone interested in a service.

Thus an advertiser promoting a fitness app could be interested in shoppers on a retail ad network who buy fitness gear, apparel, or consumables.