P2P payments occur between two people. The term stands for both “peer-to-peer” and “person-to-person.” Giving $20 to a friend for your share of last night’s dinner bill is a type of P2P payment. Paying a co-worker for the office gift fund is another.

P2P payments once involved only cash. They now include electronic funds. Square’s Cash App claims over 30 million users. Venmo, another popular app, has more than 60 million. And PayPal, the original P2P money-transfer provider, has close to 350 million active users.

Instead of using credit cards, consumers are now purchasing goods and services with P2P apps, and merchants increasingly accept P2P payments. In a sense, many merchants have become “peers” to capitalize on the trend.

Consumer Perspective

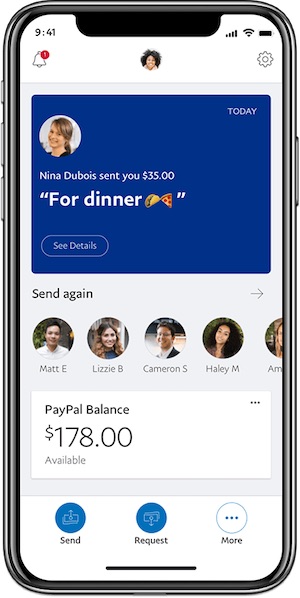

Most P2P payment apps have a similar look and feel. The consumer downloads the app, registers, and then links to either a credit card, debit card, or a bank account — collectively known as funding sources. The app transfers funds from one of these sources to the other person in the transaction. The recipient usually receives the funds immediately and can deposit into a linked bank account or retain in the app to use later.

The consumer’s perspective of P2P payments using the PayPal app.

Merchant Perspective

Merchants can accept P2P payments in one of four ways.

1. Peer-to-merchant, wherein merchants act as the recipient of a P2P transfer. This type of payment is best suited for smaller, independent merchants and occasional sellers at, for example, arts and crafts fairs, farmers’ markets, and bake sales.

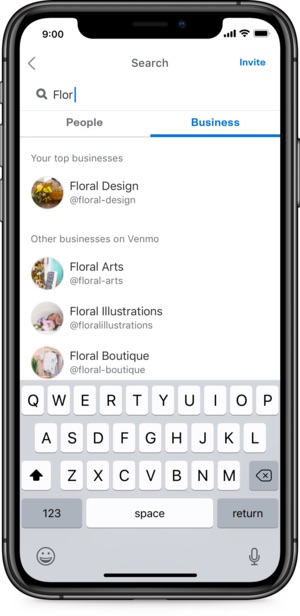

2. P2P for businesses. Popular apps such as PayPal, Venmo, Zelle, and Square Cash App offer business profiles, where merchants can create and display a QR code to their customers. The QR code can appear anywhere: inside or outside a store; on print media such as business cards, signs, and flyers; and on websites. Customers initiate payments by scanning the QR code, which will open the merchant’s P2P app on the customer’s phone. An additional benefit of business profiles is that merchants can list in the app’s directory, thereby connecting with new customers.

Using P2P business profiles, merchants can appear in the app’s directory, thereby connecting with new customers. This example is from Venmo.

3. P2P as an ecommerce checkout method. Ecommerce merchants can add P2P buttons to their checkout pages. The user experience is similar to the familiar “Pay with PayPal” option. Using Venmo, for example, after selecting the “Venmo” button, customers enter their Venmo account details and authorize the money transfer to the merchant. Customers fund the transaction from their linked bank account, credit or debit card, or their balance at Venmo. The merchant receives the payment in full, minus a transaction fee (more on this below), regardless of the customer’s choice of funding source.

After selecting the “Venmo” button, customers enter their Venmo account details and authorize the money transfer to the merchant.

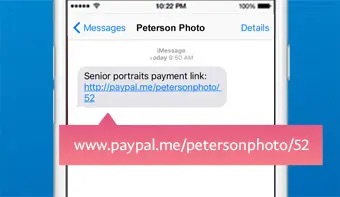

4. Payment requests are appropriate for smaller service providers such as gardeners, tutors, and freelancers. Most popular P2P apps allow users to request money. Business owners can use the app to generate a “pay me” link and send it to a customer via text message, email, or social media. The customer then clicks the link and is guided through the process of transferring funds.

Service providers can use P2P apps to generate a “pay me” link and send it to a customer via text message, email, or social media. This example is from PayPal.

Merchant Fees

For the privilege of accepting P2P payments, merchants can expect to pay fees. Fortunately, the fees are relatively low compared to accepting credit cards.

Merchants do not have to obtain point-of-sale equipment (scanners, registers, PIN-pads) or merchant accounts. All that’s required is a computer or a smartphone and an account with one or more P2P providers.

There is no charge for creating a business account with Zelle, PayPal, Venmo, and Square’s Cash App. None of these providers charge a fee for receiving P2P payments. Venmo does not charge for business profiles (i.e., Venmo business accounts), but, according to Venmo’s documentation, merchants accepting payments via their business profile could, in the future, incur a per-transaction fee of 1.9 percent + $0.10.

The only charge applicable to most business owners is an instant-deposit fee, which varies from provider to provider but usually ranges from 1.0 – 1.5 percent of the transaction amount. Venmo caps its instant-deposit fee at $10; Square’s Cash App does not offer a cap. Zelle has no deposit fee because it’s a value-added service from banks.

Merchants can avoid the instant-deposit fee by waiting 1 and 5 business days before transferring funds from the P2P account to their linked bank account. This is called the hold period: the amount of time that the P2P app will hold funds before allowing free transfers to linked bank accounts.

Currency conversion is another potential fee. PayPal allows cross-border payments, but other providers do not. Upon receiving a P2P transfer from a foreign customer, PayPal will convert to your local currency and charge $3 for the service. And the exchange rate that PayPal applies will be more costly than foreign exchange providers.

Finally, P2P payments are not appropriate for every business. Most should still accept traditional credit cards, which come with a vast array of fees.