With the holiday shopping season upon us, getting more traffic and converting more shoppers into buyers is key to reaching sales goals. Don’t miss out, though, on the potential icing on the holiday cake: a boost in customer loyalty.

A customer’s lifetime value — LTV — reflects the total amount of money he is expected to spend with your store across his entire life. Unlike return on investment, which is the dollar amount generated on a specific campaign divided by how much money was invested in it, the LTV focuses on customer spends over time, regardless of individual marketing campaigns and promotions (though definitive calculations do factor profit margins).

LTV is important because of its long-term effect on a company’s income. After all, for many retailers a large percentage of revenue comes from a relatively small percentage of customers.

Understanding LTV Calculations

A customer’s lifetime value reflects the total amount of money he is expected to spend with your store across his entire life. LTV is important because of its long-term effect on a company’s income.

Before attempting to increase LTV, understand how it’s calculated. If you’ve never taken the time to figure out how valuable customer loyalty is to the lifespan of your business, you’re missing what makes so many others successful.

Knowing the LTV, especially across various types of customers, helps you determine if you’re targeting the right shoppers or wasting money on marketing, discounts, and enticement programs by focusing on those who aren’t really spending money.

First, find the average of two different variables: customer spend per visit and the number of visits the customer makes per week.

Depending on your product lines and price points, you may want to use data from 10 or more different customers. If your business targets different types of consumers, find variables for each group and calculate LTVs separately. This will give you the best insight about expected spends over time so you can market to each of those groups accordingly.

The LTV of a customer can be calculated in different ways.

Calculation 1: simple equation. This is the most basic calculation to determine the LTV. Just multiply the average weekly spend by the average lifespan of a customer. The example below assumes a customer, on average, spends $24.30 per week, for 20 years.

LTV = Average Weekly Spend * Number of Weeks in a Year * Number of Years as a Customer

LTV = $24.30 * 52 * 20

LTV = $25,272

Calculation 2: average lifetime profit. The simple equation above is helpful, but you really need to know how it translates to overall profit. To calculate average lifetime profit per customer, use the following formula.

Average Lifetime Profit = Average Spend per Visit * Average Visits per Week * Number of Weeks in a Year * Number of Years as a Customer * Average Profit Margin

Customers at Starbucks, for example, reportedly spend, on average, $5.90 per visit, with 4.2 visits per week, for 20 years. Starbucks’ average profit margin is 21.3 percent. Thus the average lifetime customer profit for Starbucks would be the following.

Average Lifetime Profit = $5.90 * 4.2 * 52 * 20 * 0.213

Average Lifetime Profit = $5,489

Calculation 3: present value of future sales. The most elaborate LTV calculation recognizes the time value of money, and discounts future sales (or profits) to a present value. (A $10 sale five years from now is not worth $10 today due to the time value of money.) This calculation requires assigning a present value discount rate to determine the value today of a future sale.

This calculation is quite elaborate, so it’s likely a task for your company’s accountant, though here’s a helpful Excel template, to do it yourself.

Ways to Increase LTVs

The LTV of a customer is a direct result of conversion tactics and trust building. Customers need good reasons to become loyal to your company or brand. To increase the LTV:

- Be transparent. Loyal shoppers prefer honesty, even if it means paying slightly more.

- Offer great customer service. Be flexible with returns and exchanges. Help guide shoppers to the best selections. Listen to complaints and respond appropriately.

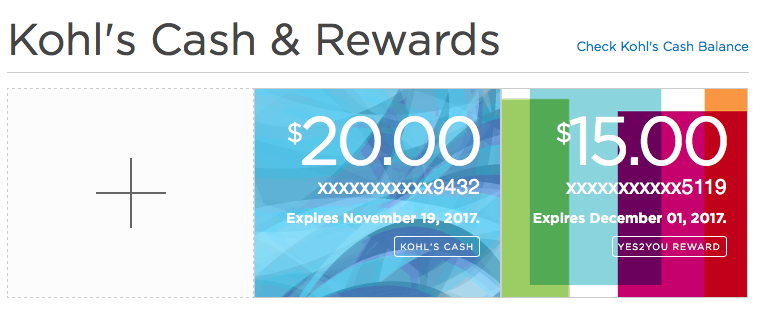

- Reward customer loyalty. Rewards programs are a good way to increase order values and encourage future purchases. Ideal offers include cash back, gift certificates, and free products or services.

With its Kohl’s Cash and YES2YOU rewards, Kohl’s is able to convert even first-time customers into loyal ones.

- Be a step ahead. When it comes to fixing problems, present an acceptable solution the first time out. Loyal customers don’t like back-and-forths.

- Make the experience quick and easy. From finding the best products to completing the checkout and tracking the order, a frustration-free experience promotes repeat business.

During the next several weeks, take the necessary steps to convert first-time and infrequent customers into loyal ones. By creating a positive experience, you can increase email signups to notify seasonal shoppers of, say, new products and site features starting in January. Maintain the momentum, and generate sales for years.