Managing the coronavirus pandemic in the United States has led to temporary store closures, social distancing, and economic concerns. People and industries are affected, including car dealers.

Vehicle sales in the U.S. might drop as much as 20 percent in the near term, according to a March 19, 2020, CNBC report. USA Today reported that “March sales alone were already down by about 38,000 vehicles.” While Motor Trend magazine pointed out that “Coronavirus wrecked China’s car sales, and America is probably next.”

Collectively these woes may drive the car industry toward ecommerce sales and impact some ecommerce-related software and services.

2 Problems

“To understand how the coronavirus could affect the U.S. auto industry, we must first understand what caused Honda sales in China to drop by 85 percent, Toyota to fall 70 percent, Volkswagen by 91 percent, and G.M. sales were down 92 percent,” wrote Scott Evans in the aforementioned Motor Trend article.

“There are two primary factors tightly linked by one overriding event: the Chinese government’s decision to put much of the Hubei province on lockdown, including the massive capital city of Wuhan. By preventing about 60 million citizens of Wuhan and Hubei province from leaving their homes except to get groceries or medical attention, China created two big problems for the auto industry. First, no one could go out to buy cars, and second, even if there were customers, auto manufacturing plants were shuttered with no one to build the cars.”

At least the first of these problems — that shoppers are staying home or that dealerships are shut down — is happening in the United States, too.

For example, Nevada Gov. Steve Sisolak ordered all non-essential businesses to shut down starting March 17, 2020, to help slow the coronavirus spread. This order created a 100-percent drop in vehicle sales for Nevada’s car dealers.

New Services

In response, many new and used automobile dealerships are trying concierge-like services and testing the potential for ecommerce.

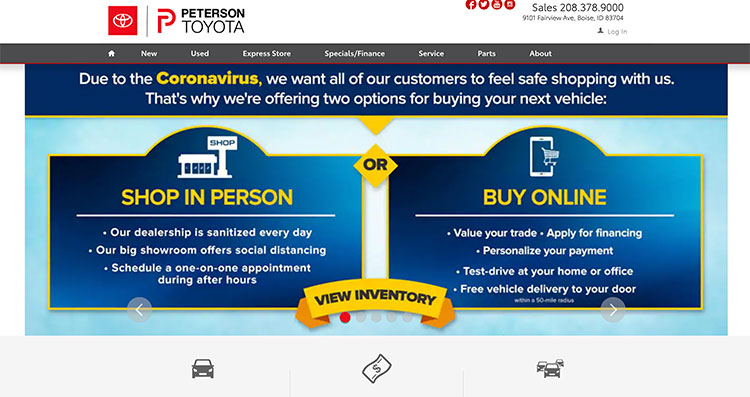

Peterson Toyota, a franchise dealer in Boise, Idaho, posted a message on its website on March 18, 2020.

“Due to the coronavirus, we want all of our customers to feel safe shopping with us. That’s why we’re offering two options for buying your next vehicle.”

The coronavirus is crushing car sales, so much so that some dealers are adding new services to sell vehicles, such as at home test-drives and online documentation.

Shoppers in the area were still welcome to visit Peterson’s dealership, or they could complete most of the buying process online, including receiving an estimated trade-in offer and applying for financing. Test drives could be done at home or at the consumer’s place of work.

This approach is by no means unique. Many automobile dealers around the United States are trying similar methods.

The owner of one used car dealership said he believed the sorts of services his company was trying — which included video calls and at-home test drives — would probably stick around longer than the coronavirus. In fact, he believed mandated closures and waning sales would push the industry closer to “e-contracting.”

Ecommerce for Vehicles

In this context, e-contracting is a specific form of ecommerce. New and used car dealers typically have state requirements which make the transaction a bit more complicated than purchasing apparel, electronics, or sporting goods, as examples. But in the end, the transaction (or much of it) could take place online.

A few companies have already been using ecommerce to sell cars. One example is Carvana.

Founded in 2012, Carvana is an online used car dealer with more than 20,000 vehicles in inventory. The company made news early on with its free vehicle delivery services (next day for about 160 U.S. markets) and its massive and showy used car vending machines (there were 23 by November 2019).

In 2019, Carvana generated $3.9 billion in revenue but lost about $280 million from operations, according to its financial reports. Nonetheless, some believe Carvana has helped to define automotive ecommerce similarly to how Amazon defined ecommerce generally.

For the company to succeed, more automobile buyers must be comfortable purchasing used cars without a test drive or without even seeing them in person.

Roadblocks

Car dealers that want to mimic Carvana and create ecommerce sales will likely face a few roadblocks along the way.

Legal requirements could play a role. Some states may still require physical forms. While these forms could be completed when a vehicle is delivered, automobile retailers will need to have a process for collecting or even reprinting forms.

Delivery costs. Carvana sends your used car to your door via a flatbed truck or places it in one of its vending machines. Smaller dealers will probably just drive to your house, but there could still be significant associated costs.

Carvana will deliver a used car the next day in about 160 US markets.

Software updates. Many car dealers depend on proprietary and outdated software is far less functional than what is in the ecommerce industry.

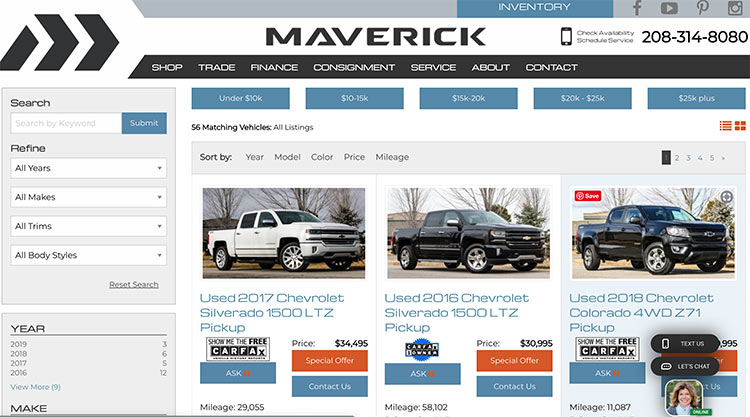

For example, car dealership websites already look like a typical ecommerce website, but they tend to run on locked-down website platforms and closed eco-systems.

Automobile dealer websites already look like ecommerce sites in many ways, including having category pages and product detail pages (called vehicle detail pages in context).

New competitors. Traditional car dealers may get new competitors. Any business with a dealer’s license can acquire cars at auction and start selling vehicles online. Some companies could use their digital marketing expertise to get ahead of traditional car retailers.

Consumer sentiment. Thanks to the coronavirus’s economic impact, car dealers may be eager to try online sales. Are consumers ready?