Online retailers often face decisions regarding their email programs. These include issues like determining ideal frequencies and crafting compelling subject lines. To help address these questions, I’ll be writing a series of case-study-type articles, pairing large, popular online retailers with different email topics. For this first installment, I’ll examine J.C. Penney’s approach to email segmentation, frequency and subject lines.

Subscriber Segmentation

I purchased products online from J.C. Penney a few times — more than three years ago. Penney’s would presumably classify me as “lapsed” customer. But I still open Penney’s emails often — partially out of curiosity but also to check out the offer. Therefore, because of my history as an “opener” and a “purchaser,” I most likely fit into the bucket of someone who is apt to convert. Thus Penney emails me frequently.

Sample J.C. Penney email, as sent to the author.

Frequency of Emails

I receive a good amount of J.C. Penney emails. But I never thought it was overwhelming — especially to the point of unsubscribing. I’ve shopped there before, and the next time I need something and a good deal appears in my inbox, it is likely that I will purchase again. It wasn’t until I started saving emails for this article that I noticed J.C. Penney emails me almost every day, even on weekends. This is apparent proof that — for a major online retailer with email analysis resources — emailing every day garners enough revenue to outweigh email unsubscribes. Interestingly, this goes against my previous articles that state not to bombard your subscribers with constant emails.

To help decide a proper frequency, attach a dollar value to every subscriber, as follows. Over time your email file will produce a certain amount of sales. Divide that amount by the number of subscribers and you’ll have a good estimate of what each subscriber is worth. This will help decide whether increasing frequency at the cost of subscribers is worth the increase in revenue.

For example, assume an email list contains 1,000 subscribers and revenue over time from marketing to that list is $100,000. $100,000 divided by 1,000 equals $100, the rough value of each subscriber. If each email causes five recipients to unsubscribe, but produces only $400 in actual revenue, the $500 of lost “value” is more than the $400 of incoming revenue. This would indicate your emails are too frequent, as they produce less revenue than the value of the subscribers that opted out.

For acquisition purposes, this subscriber-value amount — $100 in the example above — will also help evaluate options to grow your list. Using the example above, an acquisition program that costs $20 per new subscriber makes economic sense. One that costs $120 per new subscriber does not.

Also, analyze which types of subscribers are opting out. Opt-outs are not necessarily a bad thing if the subscribers were never a good fit. If it’s unlikely they would purchase anything, think of it as ending a relationship that neither party values. It will make your database cleaner and more effective.

Subject Lines

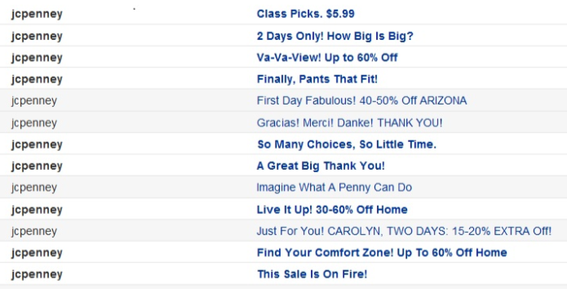

J.C. Penney also interested me for this initial case study because I noticed a trend in its subject lines. The once offer-heavy subject lines had given way to some very creative and fun ones that were different and compelling and led me to open — simply because I noticed a change. This is something any online retailer should consider. Just changing what you normally do may spark newfound interest among your subscribers and re-engage them.

In J.C. Penney’s case, the most interesting subject line for me was the blank one: there was no text on the subject-line section of the email. I was curious if the company simply made an error, or if it was testing open rates from blank subject lines. It worked on me. I opened the email and was engaged, simply because I was curious.

J.C. Penney changes its email subject lines often, utilizing personalization and discounts, as viewed in the author’s email inbox.

Try changing the patterns and organization of your subject lines. If you otherwise include a discount or sale amount, then try something funny or appealing in other ways.

Conclusion

Analyzing what major online retailers do with their email programs can help smaller merchants. Larger retailers have the staff and resources to heavily segment, test, tweak and review. Take advantage of the work they have done. Subscribe to their emails, and learn from them.