Retail arbitrage is a booming business. Some practitioners are making six-figure incomes buying low-priced or clearance items from big-box retailers or even small or mid-sized online stores and reselling those items on Amazon. Mimicking or encouraging the practice could help retail merchants manage closeouts.

Retail arbitrage is a booming business.

Most established retailers have to manage closeout or clearance items. These slow sellers occupy valuable warehouse or retail footage. They are inhibiting cash flow. And getting rid of them, even at a loss, is better than letting them accumulate dust.

Often retail closeouts enter a cycle of price cuts. Perhaps there is a 20-percent discount in the first phase. A week later the price is perhaps cut by 35 percent. Two more weeks and the discount is 50 percent. There is a final sale at 75 percent off, and eventually, the items are donated to a local charity. Often there are labor costs at each step in the markdown process.

There may be another way to move these items and reduce closeout losses.

Amazon Retail Arbitrage

The term “arbitrage” describes the simultaneous buying and selling of a stock or a commodity. It is something that precious metals traders or wily stockbrokers do to quickly earn a profit.

But the concept of arbitrage is now being applied to a new kind of online seller.

“With their two young kids in tow, Juston and Kristen Herbert drove to a Target near their home outside Scottsdale, Ariz. It was time to get to work, wrote Rachel Siegel in a February 2019 Washington Post article.

“The Herberts were on the hunt for all of the Contigo water bottles the store had in stock…Within minutes, an employee pulled out 32 two-packs — sold on clearance for $5 each — from a back storage room. For two people who recently left their jobs in finance, the blue-and-black plastic bottles might as well have been made of gold. The Herberts would resell the two-packs on Amazon for $19.95. Subtracting some taxes and fees, they’d clear $6.16 in profit. All told, the Herberts’ 10-minute Target run earned them $198.”

Seigel’s article goes on to give more examples of retail arbitrage and seemingly encourage it as a side hustle or even full-time business.

The piece was so popular it may have generated a spike in Google searches for the term “retail arbitrage.”

The popularity of the search term “retail arbitrage” has been increasing, as shown here on Google Trends. A spike in search for the phrase occurred immediately after the release of a Washington Post article.

Retail Arbitrage Process

In its simplest form, the Amazon retail arbitrage process has four steps.

- Find a profitable item.

- Buy the item in bulk.

- Ship the item to Amazon.

- Sell the item on Amazon.

Of these steps, finding a profitable item is typically the most difficult. Sellers use bargain hunting apps to identify clearance and closeout items on sale at local brick-and-mortar stores or online.

Next, they look up those items on Amazon to see if the Buy Box price (meaning the price the item is selling for) affords enough profit after Amazon selling fees, Fulfillment by Amazon fees, and taxes.

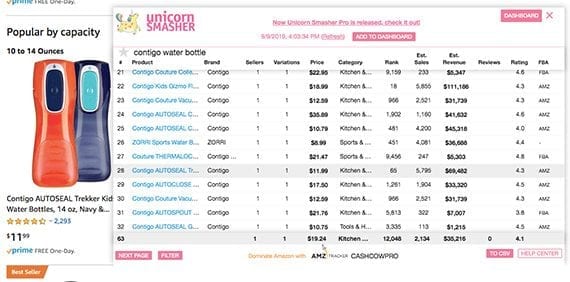

If there is enough profit margin, the seller will use an Amazon analysis tool such as Jungle Scout, Unicorn Smasher, or CamelCamelCamel to estimate how much demand and competition there is for the product. If everything checks out, the person rushes to the local Target, Marshalls, or similar and buys all of the available items in stock.

There are several tools, such as Unicorn Smasher, to estimate product demand and competition on Amazon. These tools may help a seller decide if a product would be successful there.

Retail Closeouts

There are at least two things your retail business can do to better manage clearance and closeout items.

And by “better manage,” I mean to reduce losses, reduce associated costs, and reduce how long it takes to sell clearance and closeout items.

Encourage retail arbitrage. Once your business has decided to close out an item, stop trying to sell it retail. Instead, market it directly to Amazon sellers.

There are a couple of ways to do this.

You could build a list of interested, bulk buyers. Creating the list could take a bit of work. You might need to look up sellers of similar products on Amazon. Message them or otherwise find them offline. But once you have your list, send an email the next time you have a new closeout item.

You could sell the items in bulk on eBay or similar auction websites. For example, if you have 32 two-packs of Contigo water bottles, you could list them as a single item with a minimum price of $200. You might make more than selling them separately.

Participate in retail arbitrage. Your company could also sell the closeout item directly on Amazon through a subsidiary or division.

Your retail business could set up a separate company with a different name to protect your established retail brand. To close out an item from your primary store, your business would transfer it to the separate company at cost.

An employee at the separate company would pack and ship the item to Amazon, add the Amazon listing, and manage any customer questions.

In both cases — encouraging or participating in retail arbitrage — your company may be able to rapidly sell closeout items while investing relatively less labor and retaining more profit.