The more complex a commission structure is, the less likely an affiliate is going to prioritize your products. For example, say that you pay different commission rates for different product categories. You’re doing this with the intent of incentivizing affiliates to promote your higher margin products. However, in my experience, this could create resentment by affiliates toward the lower commission rates.

You can still achieve the same objective, and avoid affiliate resentment, by creating a flat commission structure across all product categories, and then running bonuses and promotions around your higher margin products.

For example, for the month of August, you could offer a $50 bonus for hitting a certain sales target for a particular product category. Or perhaps you could increase commission on that particular product category for a specific period of time. This approach creates less confusion about your commission structure, and serves as a way to keep affiliates engaged and activated.

Keep Commissions Simple

When you set your commission structure, it should be fair and easy to understand. Ideally, you would set your commission at a manageable rate, so you never have to lower it. No matter what the reason, lowering a commission rate results in disappointed affiliates.

It’s always tempting to launch a new affiliate program with a high commission rate to attract as many affiliates as quickly as possible. However, when you have to lower the commission rate a couple months later, you’ll likely see a drop-off in affiliate activity. Instead, launch with your standard commission rate, but run a limited-time promotion that rewards or bonuses affiliates the extra commission based on performance.

Who Receives the Commission?

Another commission rate structure to consider is based on attribution. It is not uncommon for customers to exit the checkout process to search for a coupon code when they see a field to enter that code in the shopping cart. They’ll do a search for your brand and the term “coupon.” They will likely find a code on a coupon or deal site.

They’ll click through the coupon site to get access to the code, and will resume their purchase on your site. The challenge here is that if you are using last-click attribution, the coupon site will receive credit for the transaction even though it did not enter the consumer’s click path until the end of the transaction process.

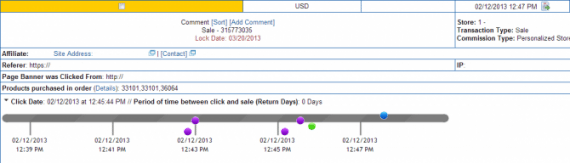

Sample of the ShareASale affiliate clickstream path. Each dot represents a different affiliate interaction within a single transaction.

The coupon site likely did play a role in pushing the consumer to complete the transaction. However, does the site deserve full commission? What if the consumer originally came to your site based on a product review she read on a blog? If you’re using last-click attribution, that blog won’t get any credit for the completed sale.

Using Attribution-based Commissions

One way to address this issue, is by using an attribution-based commission structure. Many affiliate networks offer this capability. Using attribution-based commissioning, you can set up rules that award a commission based on where the affiliate is located in the click path. For example, you can set up a rule where if a coupon affiliate enters the click path within 2 minutes of checkout, that the affiliate only receives 1 percent commission.

You can also have the tracking platform check for a prior affiliate that should receive commission for the sale, and you can either choose to award that affiliate full commission, or a share of it.

In the preceding example, I used a 2-minute window before checkout. This amount of time will likely vary depending on the retailer, but you can determine a reasonable window by looking at your analytics and determining how long it takes an average consumer to proceed through checkout.

This is a somewhat complex commission structure, but worth communicating to affiliates. In many cases, your content-based affiliates will be appreciative because it does help protect their referrals.

Traffic from Coupon Sites

It is also important to note that not all transactions driven by a coupon or deal site follow this route. Many coupon or deal sites have built a loyal and active following by providing curated deal content. Their readers will often start their shopping journey by browsing this content. I have seen programs enjoy a 20 to 30 percent new-customer ratio from deal sites. This will vary by retailer, but the point is that not all coupon traffic is undesirable.

Finally, it is possible to create a commission structure where you pay affiliates based on new or existing customers. Sales from new customers would receive a higher commission rate, while sales from existing customers would receive a lower rate. This is possible to set up. You would either pass a parameter back to the tracking platform with each sale, letting the network know whether or not the transaction should be associated with the new or existing customer commission, or you could do some sort of batch process on a regular basis.

The drawback to this commission structure is that there is no transparency to the affiliate. The affiliate has no way to tell whether or not his reader is a new or existing customer for you. Because of this, he will likely promote your products in the same way to all readers. As such, is it really worth it to pay a higher commission for new customers, knowing that it doesn’t serve to incentivize the affiliate to promote your products any differently?

Every affiliate program is different. However, the biggest mistake that I see retailers make is setting commission rates based purely on profit margins, without taking into account the impact that the commission structure will have on affiliate perception of the program. Commission structures should be fair, easy to understand and track, and well thought out.