Business leaders intuitively understand that brand recognition is important for sales and growth. But it’s often difficult for those leaders to know how to expand or improve that recognition.

What’s needed are reliable ways to measure brand awareness.

Brand and Awareness

The term “brand” has multiple meanings depending on the context. For this article, brand represents market strategy and reputation. It is the combination of the company’s self-promotion and accumulated customer experiences.

A positive brand has real advantages. Think about mobile devices. Many consumers purchase iPhones not because of their features but because of an affinity for the Apple brand.

Brand awareness then describes how well customers and prospects recognize and understand a company or its products.

Many advertisers list brand awareness as a goal despite being more challenging to measure than, say, conversions or clicks.

Nonetheless, there are at least five good ways to monitor brand awareness. They are especially helpful when used together.

Measuring Brand Awareness

Surveys. In 2011, a regional U.S. omnichannel retailer that had been in business since the 1950s surveyed a statistically significant sample of residents from a market where it had seven stores.

The company, which specialized in farm and ranch merchandise such as feed, tack, and jeans, asked folks 10 questions, including if they recognized the retailer’s name and products.

The results were alarming. Many consumers recognized the store’s name and even picked out its logo, but more than half of respondents thought the company sold plumbing supplies.

The results gave the retailer a good place to start with marketing and advertising. Over the next several years, the chain changed its advertising approach and conducted extensive brand awareness surveys every six months.

Over time, brand awareness changed. Eventually, 70% of respondents could identify the store’s brand and the product categories it sold.

Well-built brand surveys — online, telephone, in-person — are an effective way to measure brand awareness.

Qualtrics, Adobe Experience Cloud, and similar services can help to set up and conduct brand awareness surveys.

Software such as Qualtrics’ brand tracking can help set up and conduct awareness surveys.

Direct traffic. In web analytics, direct traffic describes visitors to a site who arrived by typing the URL directly into the web browser, following a link in the company’s email, or clicking a bookmark.

For the most part, direct traffic indicates familiarity with a brand.

Imagine a business running ads on YouTube. The ads are low cost, perhaps a penny per view, but clicks are relatively rare since the ad is akin to a television commercial. What’s more, many folks watch YouTube on a television screen which makes it difficult to get interactions.

A solution for measuring performance is to monitor direct traffic. If the ad makes someone aware and interested in the brand, they are likely to visit the website.

Thus direct traffic can be a gauge of brand awareness.

Recall tests are lightweight brand surveys focused on whether a prospect remembers a brand or one of its advertisements.

For example, imagine an online store that has been running ads on Facebook. The store wants to know if the ads have raised awareness, so it surveys Facebook users.

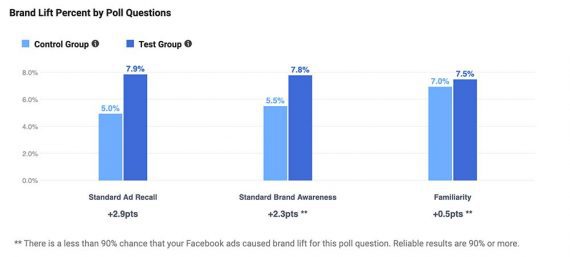

This ad recall survey will contain two groups — a control group that did not see the ads and a test group that did. Both are asked if they remember seeing the ad. The difference between the two groups is called brand lift.

Both Facebook Ads Manager and Google Ads offer recall testing.

This is an example of a Facebook brand recall survey. This type of survey is available via “Experiments” in the Facebook Business Suite.

Brand mentions, reach. Social media is an excellent tool for monitoring changes in brand awareness, in a couple of ways.

First, a business can monitor over time the number of followers, fans, subscribers, or interactions. A subscriber on a company’s YouTube channel is certainly aware of the brand. Thus, subscriber growth indicates the direction and rate of brand awareness lift.

Second, a company can monitor how often its brand is mentioned independently of its own social media properties. Social listening tools such as Mention do this with ease.

Increased mentions week in and week out point to growth in brand awareness.

Conjoint analysis. Businesses with analytics expertise could use conjoint or discrete-choice analysis to measure both brand awareness and affinity and to identify features or offers that are most important to consumers.

Consider an example. One of the challenges in identifying important product options is that customers cannot tell you what they want.

Ask if low price or high quality is more important, and a typical shopper will say she wants both.

To overcome this problem, researchers ask folks to consider features jointly — “conjoint” is the smushed-up version of “consider jointly.”

For example, you might ask someone to compare the Tesla Model 3 Performance to the Lucid Motors Air. Both are electric vehicles. The consumer has to weigh the utility of brand, price, and range and make trade-offs.

Give folks enough of these features to choose from, and it is possible to identify and rank them. Brand could be one of the choices.

Here’s an explanation from Gerry Katz of Applied Marketing Science, a research and consulting firm.