Convenience and security increasingly impact online selling. That’s especially the case for the upcoming holiday season, as consumers will likely seek flexible, seamless payment options.

Here are four payment methods to consider for this year’s holiday selling.

4 Payment Methods

Buy now, pay later. Expect this method to gain momentum for the 2020 holidays. Unlike traditional layaway, where consumers make payments on products before taking delivery, BNPL allows customers to pay for purchases over time after receiving the goods. Merchants process these orders like any other.

The latest offering is PayPal’s “Pay in 4,” which lets customers pay for orders from $30 to $600 interest-free over six weeks. Merchants receive the money upfront and pay only the standard PayPal rate. PayPal assumes all the payment-acceptance risks.

There are other BNPL options, such as Afterpay and Klarna. But Pay in 4 brings with it PayPal’s 300 million global users, which dramatically increases the chance of a customer already having an account.

Apple Pay. The number of iOS and macOS devices pales in comparison to Windows and Android OS. Still, on average, Apple users spend more money per transaction — up to three times as much. They’re also more apt to purchase nonessential items and luxury gifts.

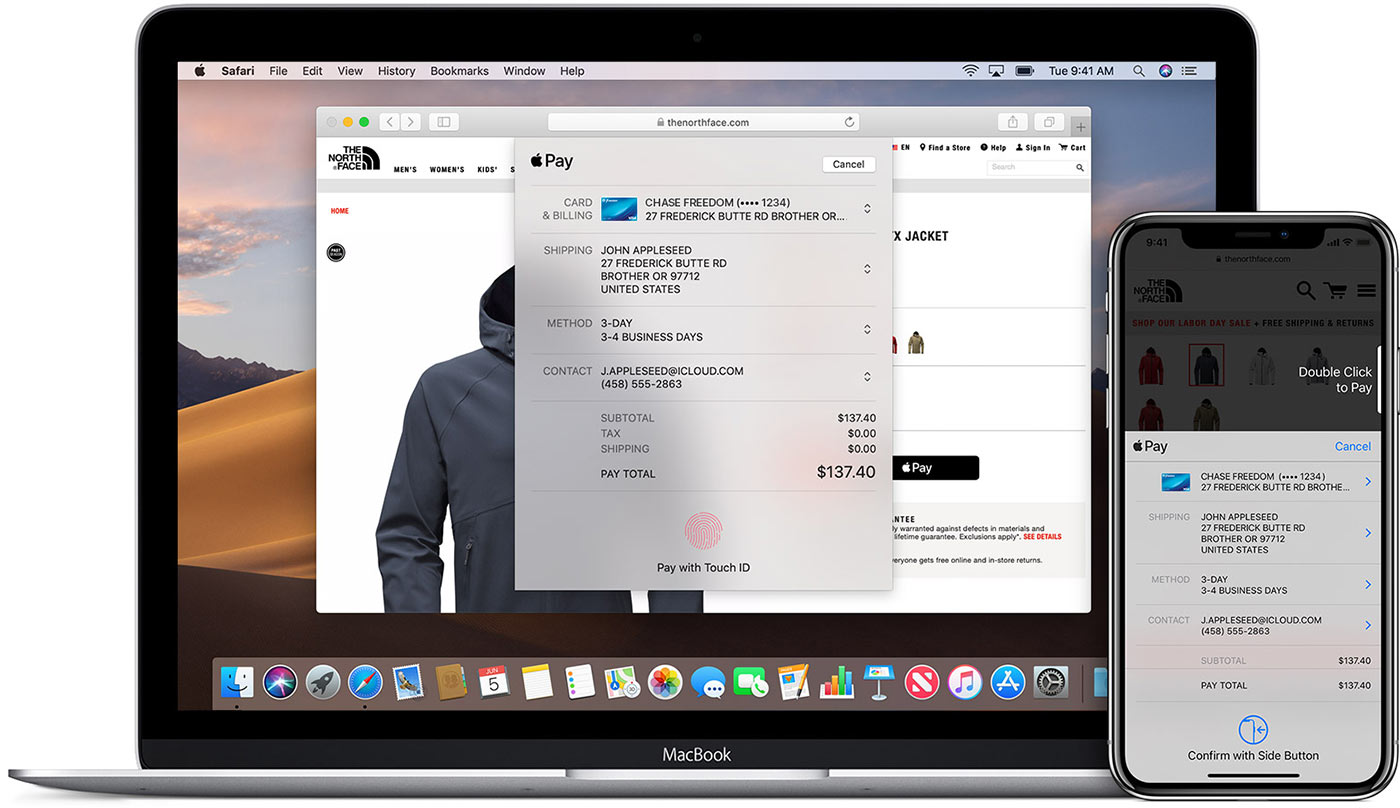

Apple Pay is a preferred method for many consumers because of its efficiency and security. Consumers keep their credit card info on file with one source — Apple — and merchants receive the information needed to process the order. Apple Pay can also work on Macs. Thus consumers don’t have to use their iPhones to complete a transaction.

There’s typically no additional charge to merchants to accept Apple Pay. Merchants pay their normal credit-card rates. But merchants do need a shopping cart that supports Apple Pay.

Apple Pay integrates with macOS and iOS devices for a quick and seamless checkout. Source: Apple.

PayPal, Venmo. PayPal and Venmo have been the most-used methods to send money to family and friends during the pandemic. Now, with many of those accounts having positive balances, consumers are more likely to pay with them rather than transfer funds to bank accounts.

While Venmo hasn’t yet rolled out business accounts, consumers can pay with Venmo funds via PayPal. For this to work for ecommerce purchases, merchants should integrate PayPal with their checkout. Instead of a Venmo button, consider making a “Venmo accepted” indicator.

Beyond Venmo, consumers can store credit card details with PayPal, paying merchants with a single tap.

Amazon Pay. Expect to see more shoppers using Amazon Pay this year. The reasons are three-fold: Amazon Pay ensures security and privacy; consumers have Amazon gift card balances to spend; and, for many, it’s convenient as, like Apple Pay and PayPal, their credit info is saved there.

Beyond Credit Cards

Traditional credit card payments require consumers to enter their shipping, billing, and payment information. But the methods discussed here transfer those details automatically. The customer does little more than confirm the shipping address and shipping method before the order is complete.

PayPal and Amazon Pay do more than credit-card providers to protect merchants, which decreases the risk of illegitimate chargebacks. That alone can save merchants time and money, making slightly higher discount rates worthwhile.

Moreover, Apple, PayPal, Venmo, and Amazon come with huge built-in audiences. Some of those users will likely seek out participating stores.

None of these methods will replace credit cards alone. But the benefits to merchants are substantial. Implement the ones you can to gain additional traction this season.